Connect Retently

with other apps

using Segment

Send surveys triggered by Segment events, collect and analyze customer feedback in Retently.

Start Free Trial

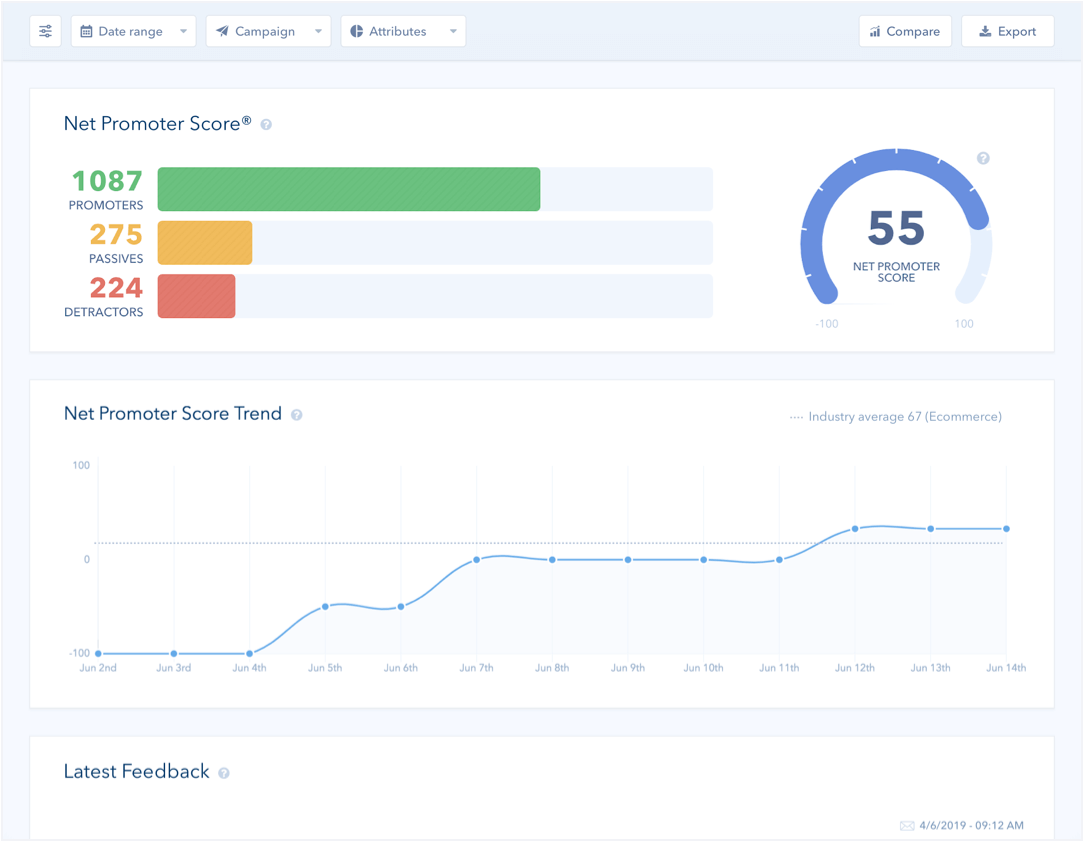

Track and improve customer satisfaction

Use Retently to get a constant pulse on your customer satisfaction and gain an accurate understanding of how your company, product, or service is perceived.

Uncover areas that require improvements or strengths that put you ahead of your competition.

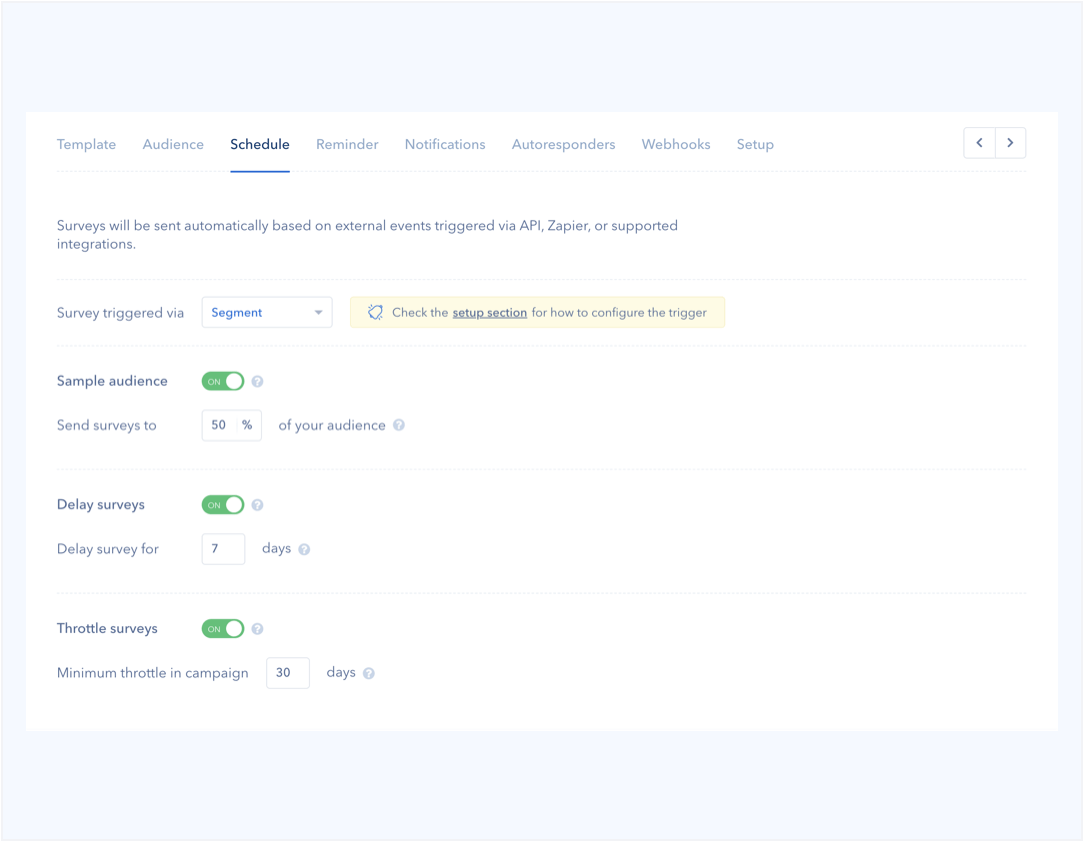

Send customer surveys triggered by Segment events

Connect Segment and send transactional email surveys when your customers trigger specific events.

Sample your audience, delay, or throttle campaigns to avoid over-surveying customers.

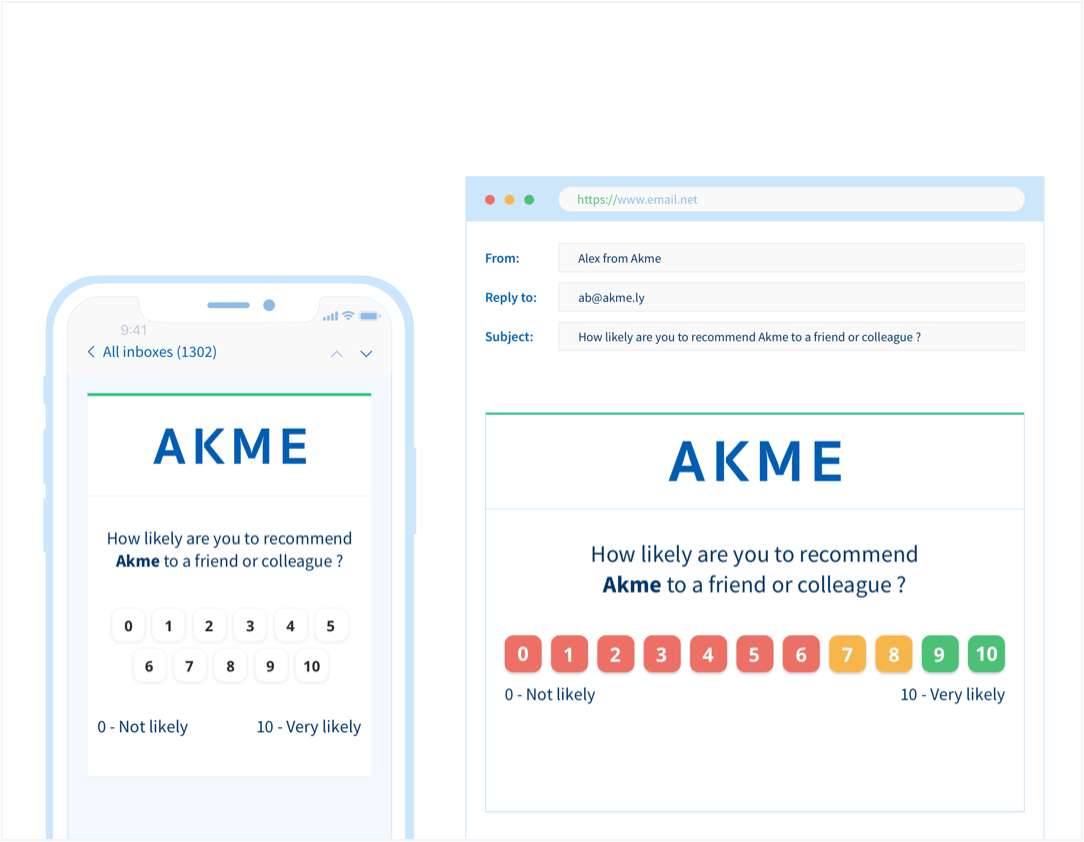

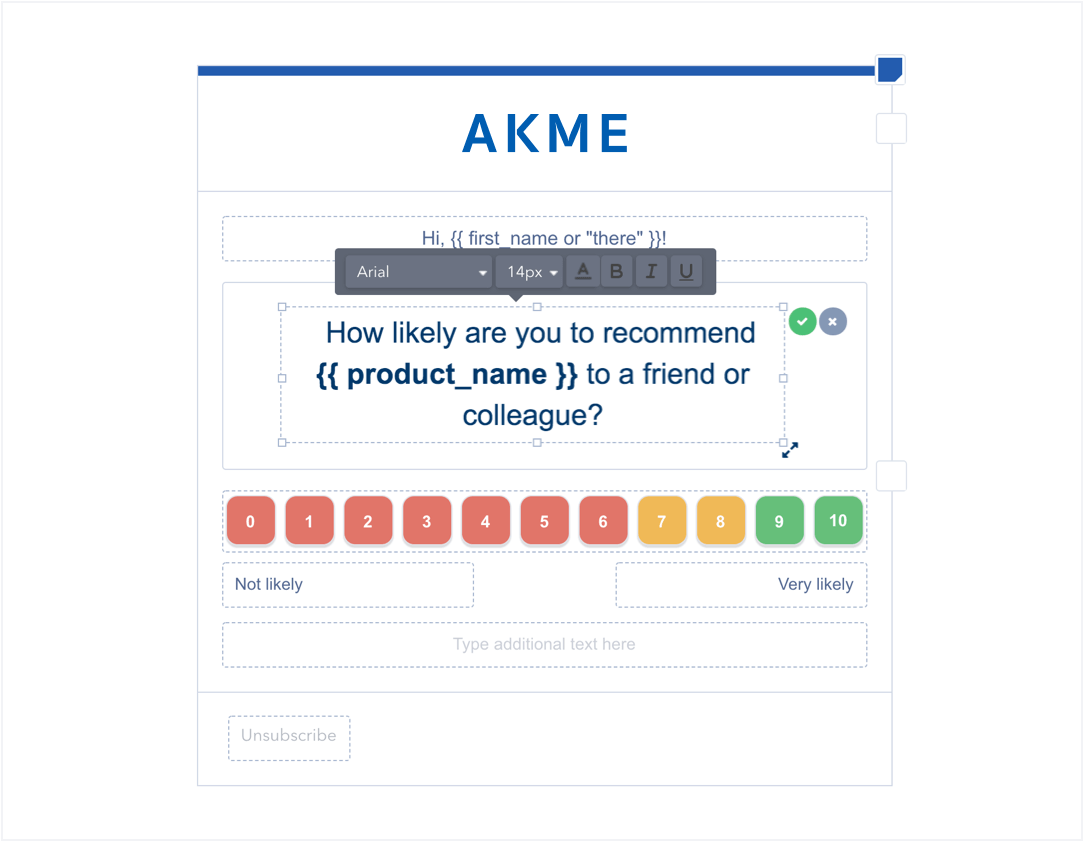

Send automated, personalized surveys

Send customized and highly personalized email surveys to your customers.

Automatically follow-up or send reminder surveys to the ones who did not provide feedback.

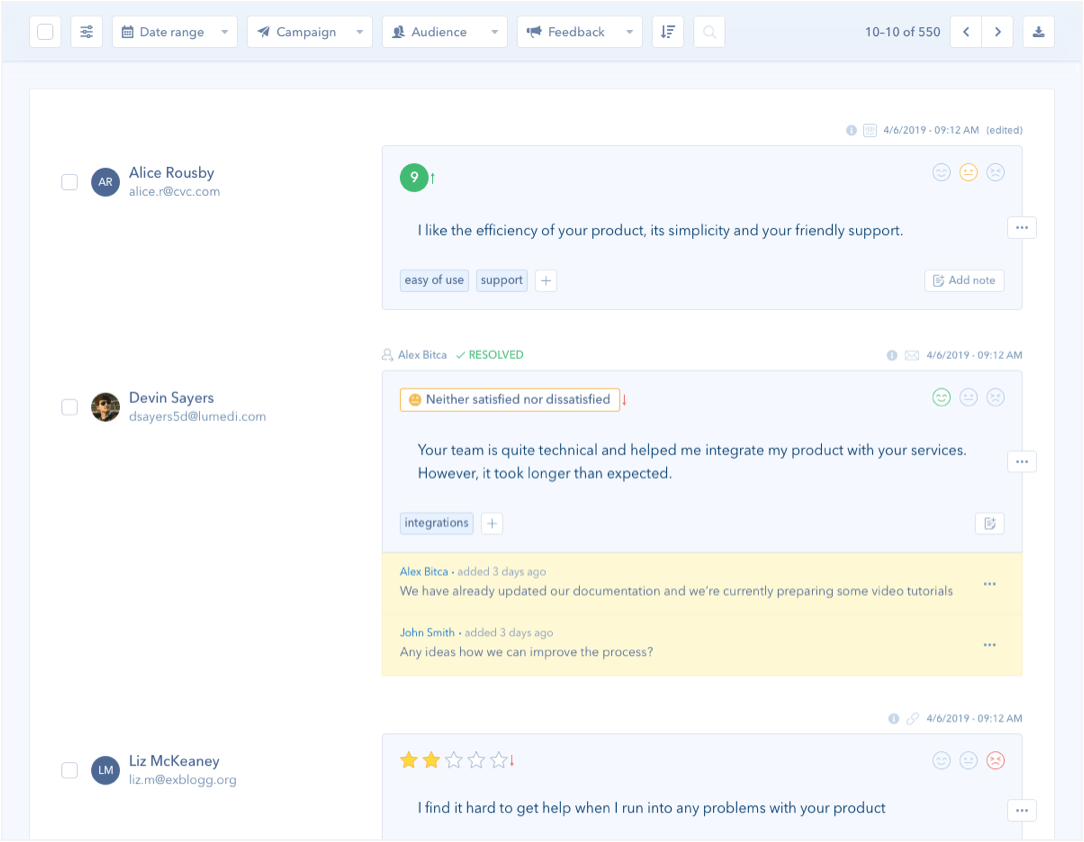

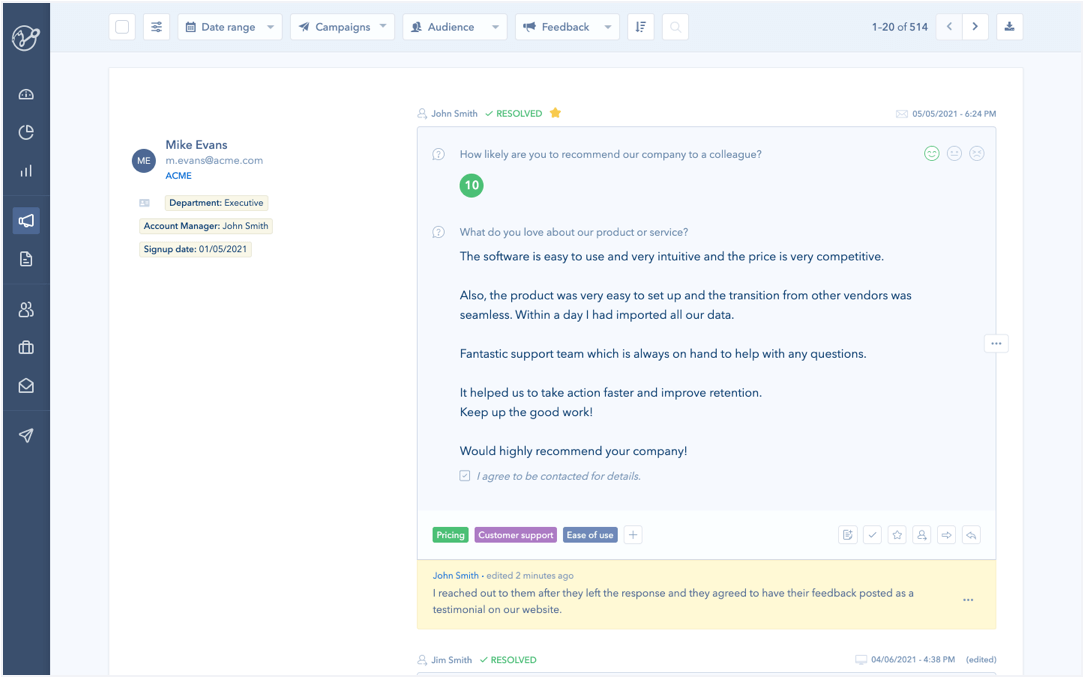

Close the feedback loop

Send survey reminders and automatically trigger personalized autoresponders based on the received survey score and feedback.

Follow up with unsatisfied customers to learn more about the challenges they’re facing, or invite Promoters to your referral program.

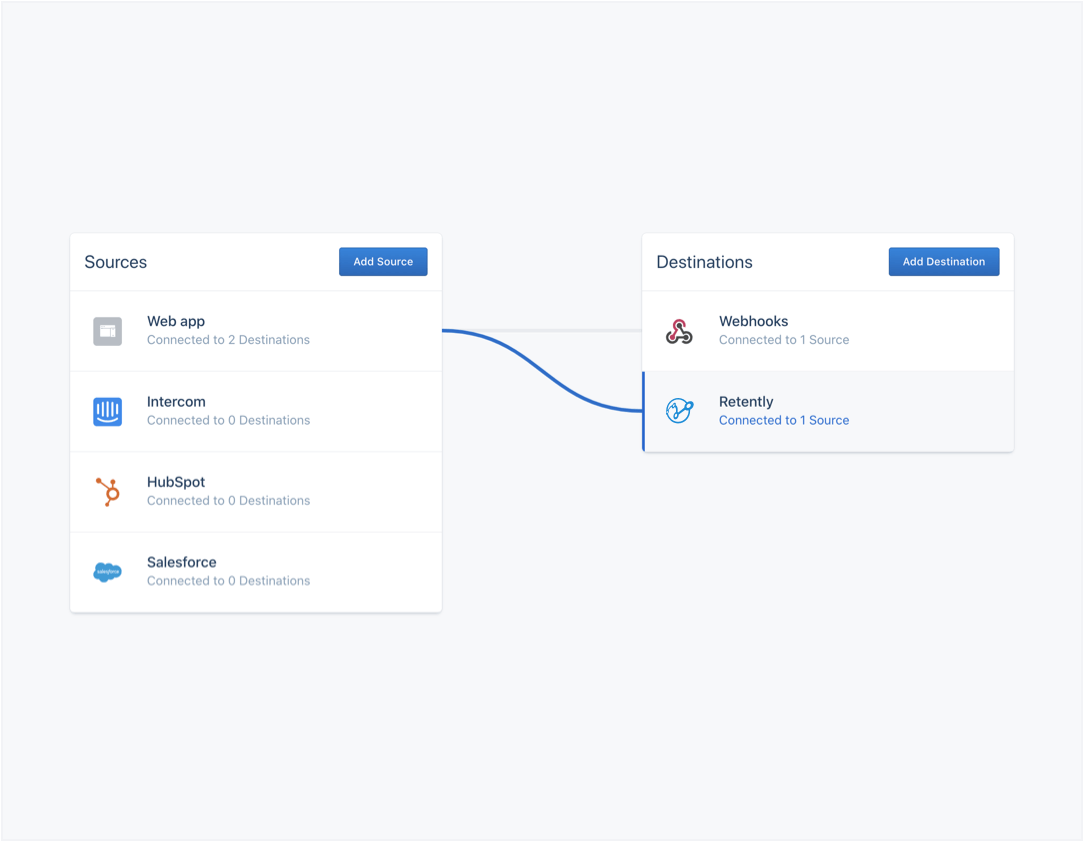

Integrate code-free, no developers required

Integrate Segment and Retently quickly and hassle-free!

The integration setup is code-free and doesn’t require developers. Just add a Retently API token in Segment and select the events that will trigger the survey.

Connect your

Segment account

Get Started