Customer satisfaction surveys for Salesforce

Sync contacts and accounts from Salesforce, send customer surveys triggered by Salesforce workflow rules, collect and analyze customer feedback and add it to Salesforce.

Start Free Trial

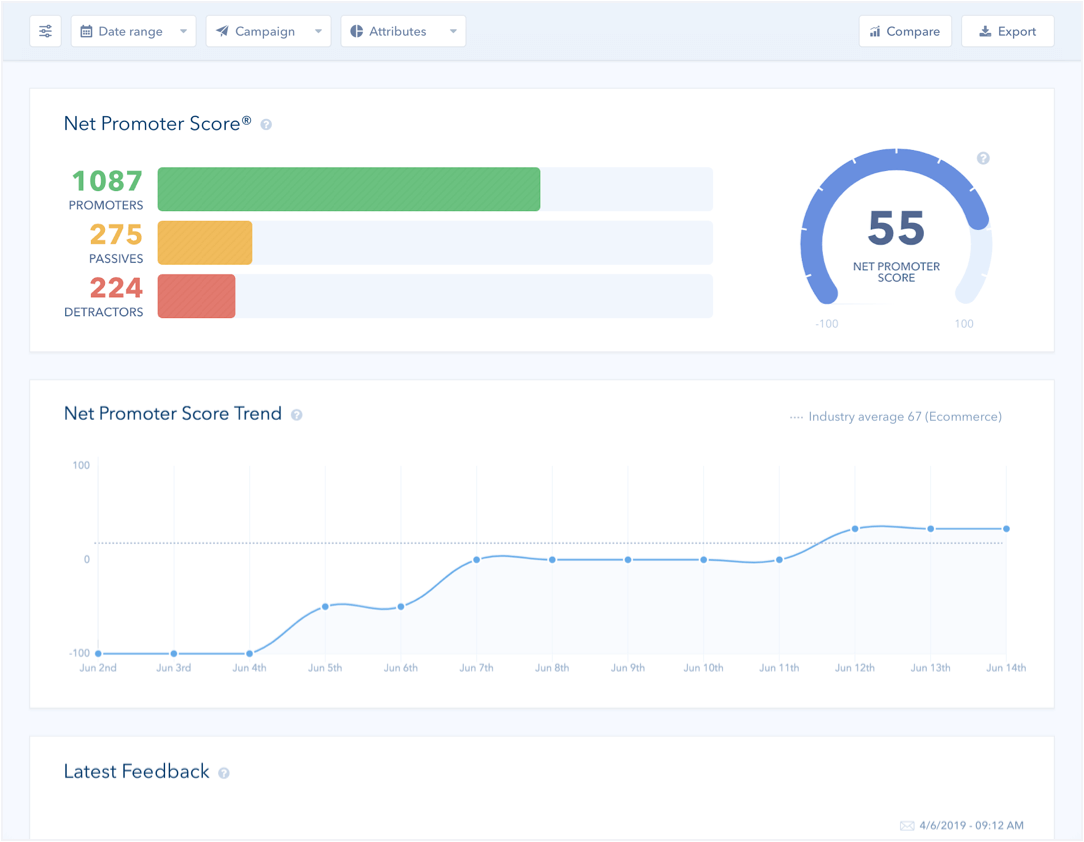

Track and improve customer satisfaction

Use Retently to get a constant pulse on your customer satisfaction and gain an accurate understanding of how your company, product or service is perceived.

Uncover areas that require improvements or strengths that put you ahead of your competition.

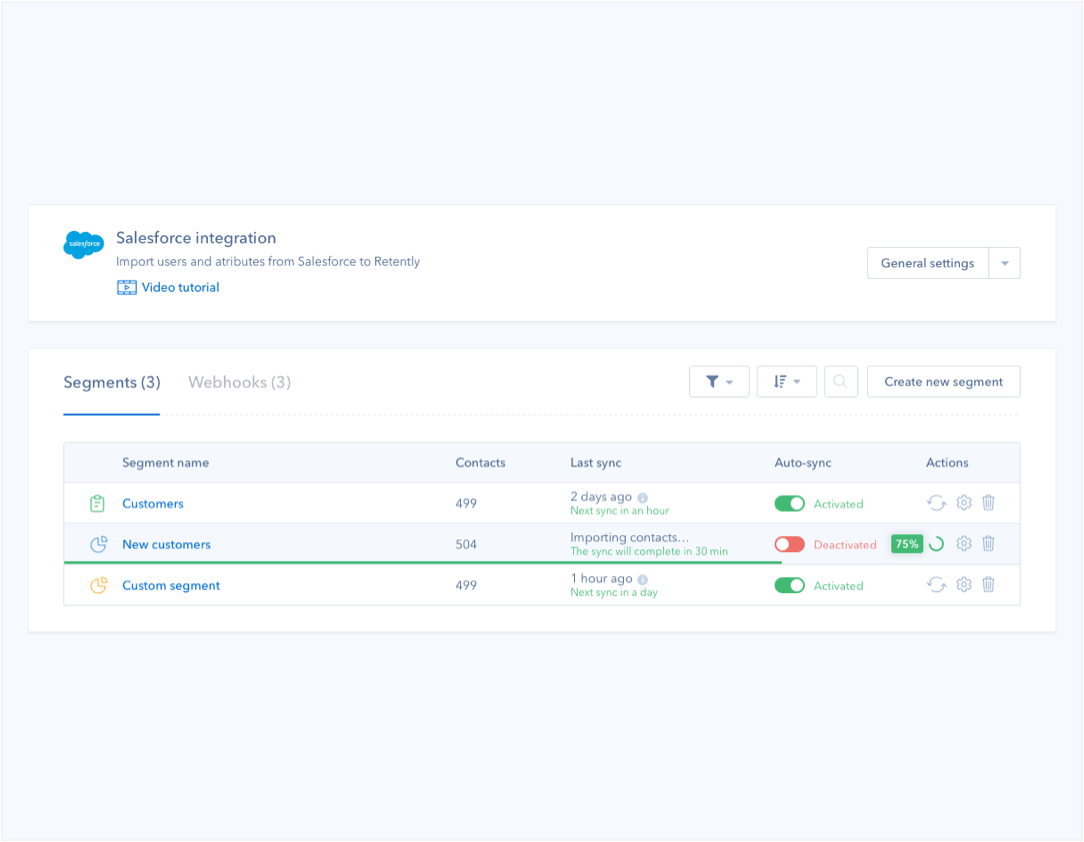

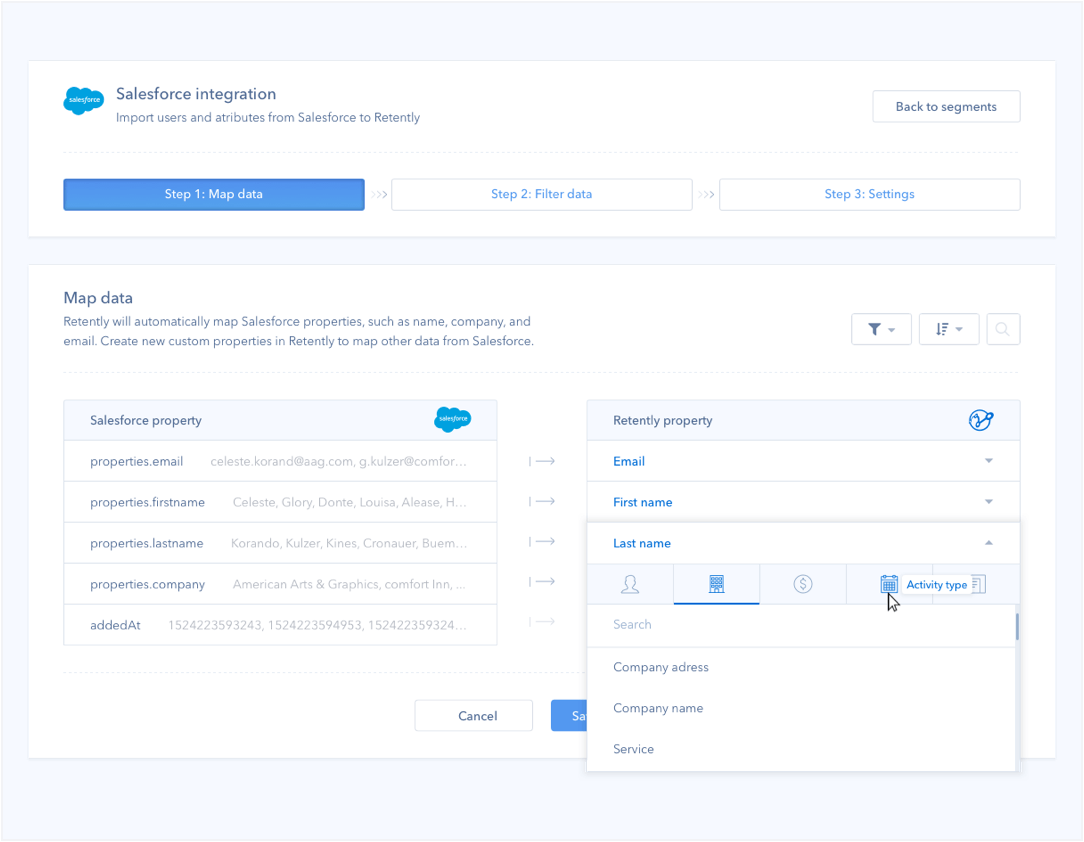

Sync your contacts and their fields from Salesforce

Sync contacts from Salesforce to Retently to easily filter NPS results by customer segment, region, product or any contact fields available in Salesforce.

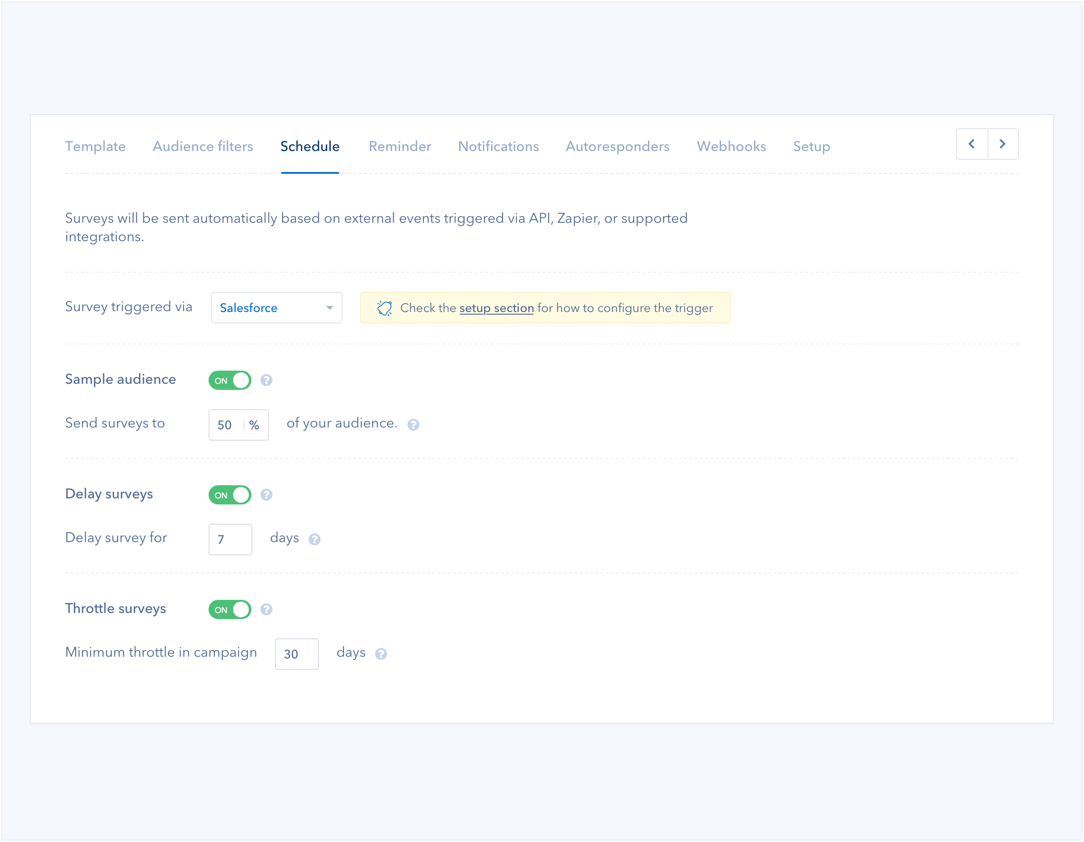

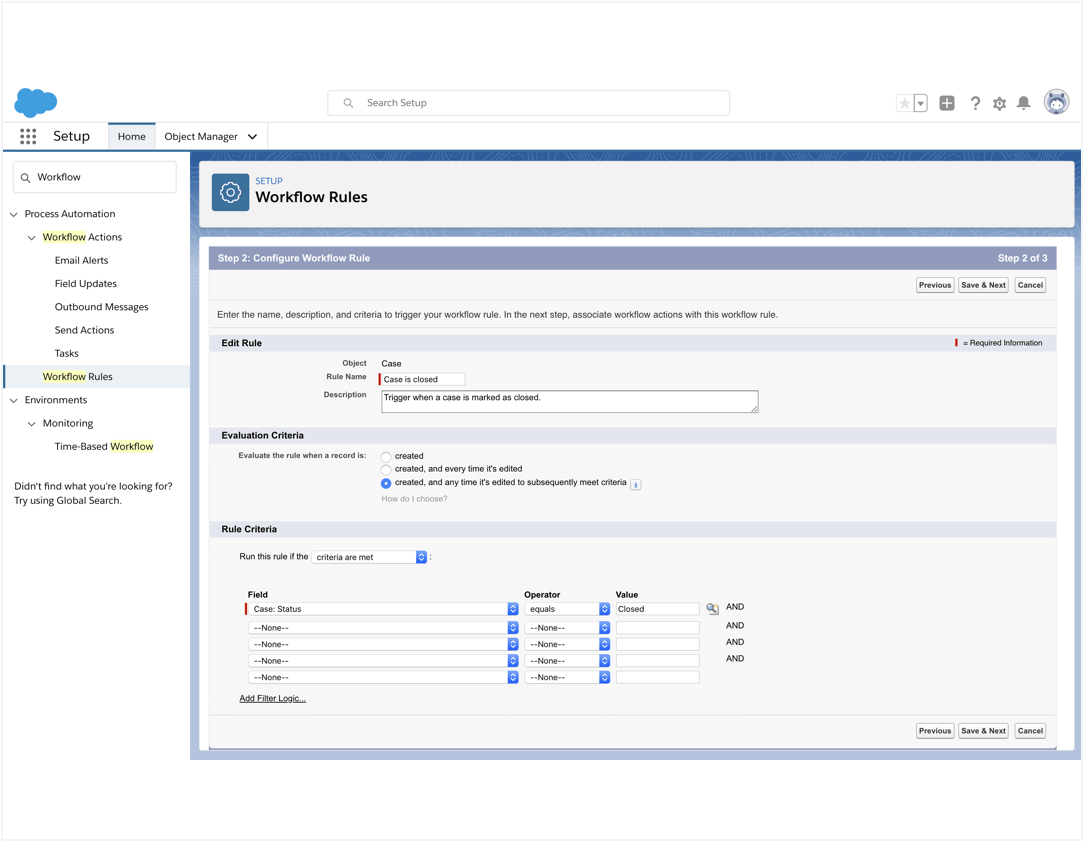

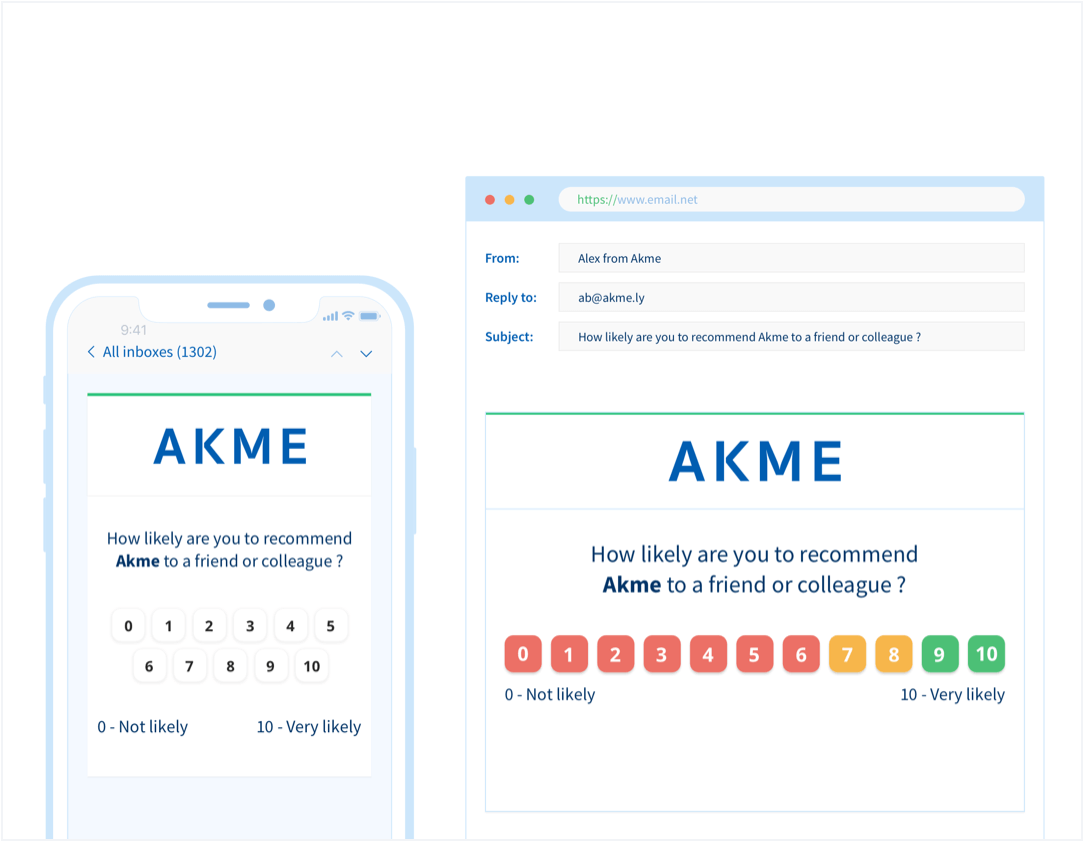

Send customer surveys triggered by Salesforce events

Add a Retently webhook link in a Salesforce workflow rule and send transactional email surveys when contacts or accounts trigger specific events, such as when a case is marked as closed or when their properties are updated.

Sample your audience, delay or throttle campaigns to avoid over-surveying customers.

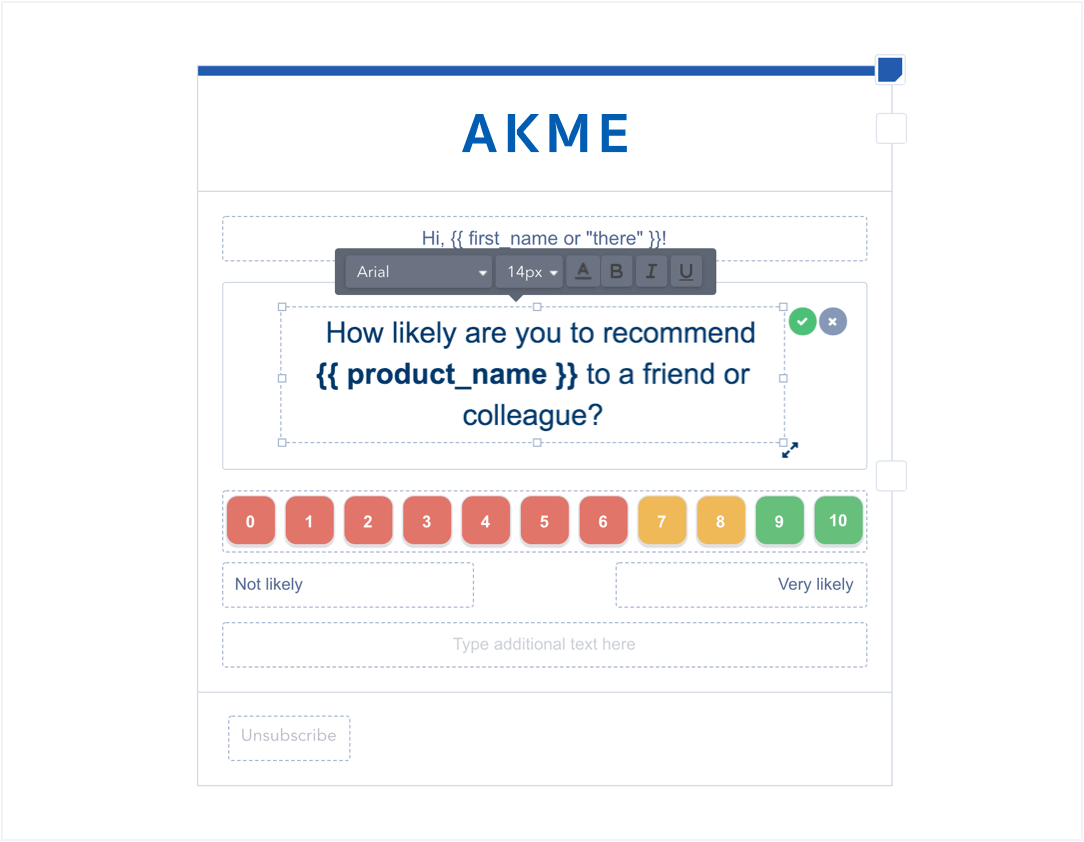

Send automated, personalized surveys

Reach Salesforce contacts via automated and highly personalized survey campaigns.

Automatically follow-up or send reminder surveys to the ones who did not provide feedback.

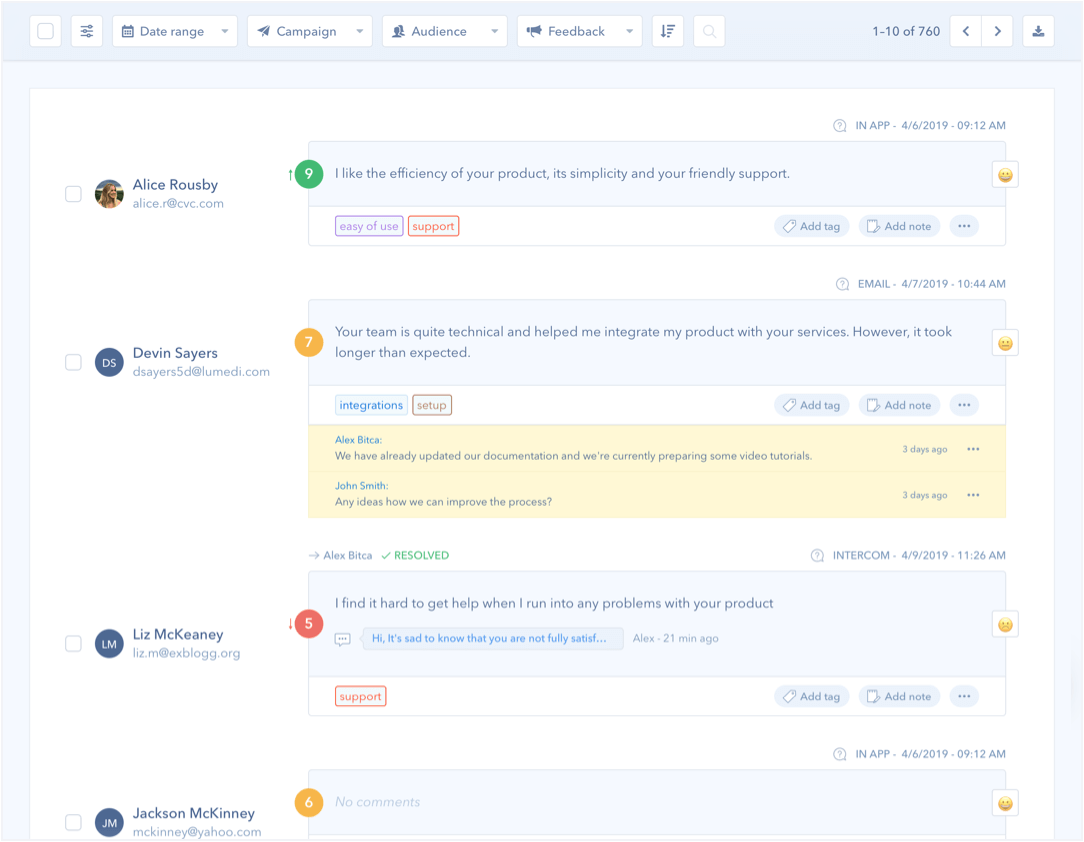

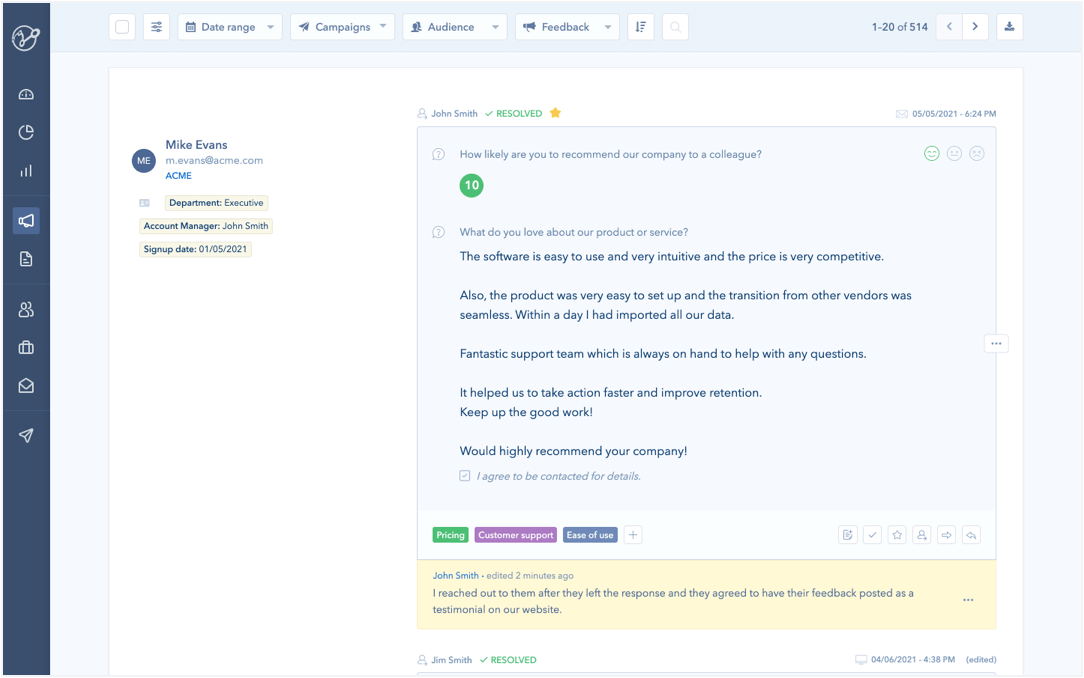

Close the feedback loop

Send survey reminders and automatically trigger personalized autoresponders based on the received survey score and feedback.

Follow up with unsatisfied customers to learn more about the challenges they’re facing, or invite the Promoters to your referral program.

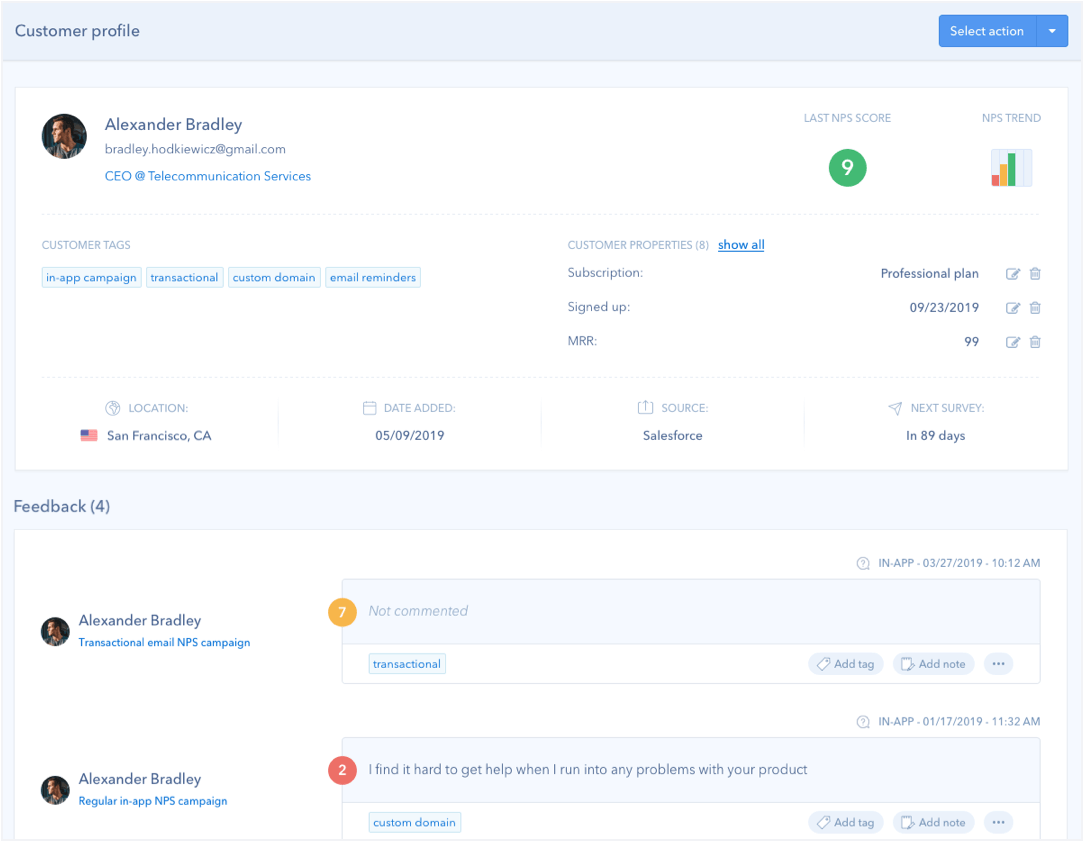

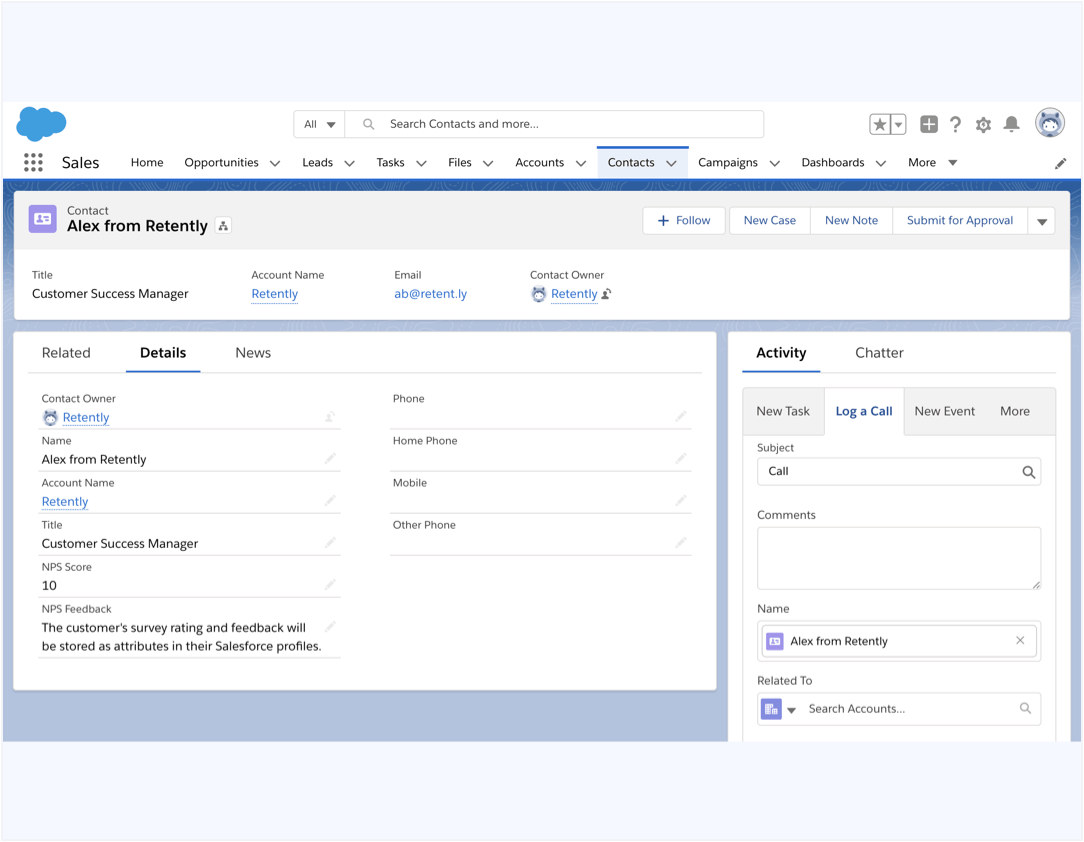

Automatically export survey feedback and score to Salesforce

Collect survey feedback and send it straight to the contacts’ profiles in Salesforce.

Use this data to segment your customers based on their score and feedback, and trigger personalized messages.

Integrate code-free, no developers required

Integrate Salesforce and Retently quickly and hassle-free!

The integration setup is code-free and doesn’t require developers - just authorize your Salesforce account, create a new survey campaign, and start collecting valuable customer feedback.

See the Salesforce integration in action

Schedule Call